Insurance for Sole Traders

Insurance for Sole Traders in Australia Home Comprehensive Guide to Insurance for Sole Traders in Australia Since accidents can happen even in the best-managed workplaces, as a sole trader, you need to bear the responsibility for any damages caused by your business. Insurance for sole traders is essential to ensure comprehensive protection. Every individual working […]

Benefits Of Professional Indemnity Insurance Cover for Your Business

Benefits Of Professional Indemnity Insurance Cover for Your Business Home Benefits Of Professional Indemnity Insurance Cover We all live in a professional world that is always quite susceptible to regular mishaps and problems. Such issues can hamper our daily lives and certain times can cause some friction in our professional lives. Professional Indemnity Insurance is […]

How To Choose a Professional Indemnity Insurance In Australia?

How To Choose a Professional Indemnity Insurance In Australia? Home Professional Indemnity Insurance Imagine you are an independent business owner, working in an autonomous avenue by assisting people and giving them experienced advice and services to guide them further. There might be times when your advice can be misinterpreted by clients and there are also […]

Professional Indemnity Insurance for Service Providers

Professional Indemnity Insurance for Service Providers Home Australia is a land of independent minds and entrepreneurs who wish to work on their own fundamentals and notions. For an enterprise that operates on a seemingly small and medium scale/level, it becomes quite difficult to find the professional indemnity insurance which is reliable, effective, and above all, […]

The Average Cost Of Public Liability Insurance In Australia?

Home Public Liability insurance is an necessary consideration for businesses of all types weather you a restaurant owner, medical malpractice or a shop owner. The cost of public liability insurance can vary based on various factors. On an average, small business owners can expect to pay approximately $69 per month for Public Liability coverage. Cost of Public […]

Business Management Liability – What’s it all about?

Business Management Liability – What’s it all about? Home What on Earth is Business Management Liability Cover? Business Management Liability Insurance exists to cover the exposures and risks in managing a business. Directors, managers and officers all face personal and corporate liabilities in managing a company. It’s in the contract that you sign, or that […]

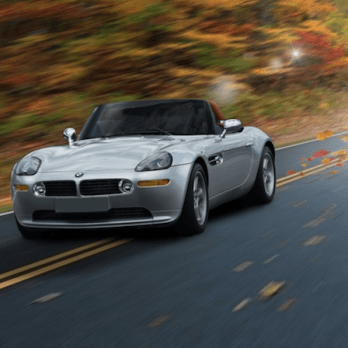

Personal and Commercial Vehicle Insurance

Home Why do you need a Commercial Vehicle Insurance? As you’d expect, the vast majority of personal and commercial vehicle insurance claims revolve around damage. There are vastly different ways of claiming for each and every eventuality. That depends on damage, fault, people involved, location and many other factors. You can even claim for accidental damage that you personally […]

Cyber Insurance and You

Cyber Insurance and You Home Business Cyber Insurance is something you NEED. Small Business Cyber Insurance is often something people associate with large technology companies. However, it’s the smaller businesses that are more likely to become victims. When you don’t have your own IT department or expert on the team, it can quickly become a problem. Cyber crime […]

Protect Your Business with Small Business Insurance in Australia

Home Starting Out – Protecting Your Small Business in Australia Starting out with your own business can be an exciting but worrying time. You are filled with enthusiasm and ideas and focused on developing products, networks and clients. The last thing you want to be worrying about is what to do when things go wrong. […]

Home and Contents Insurance – Keeping safe what matters

Home and Contents Insurance – Keeping safe what matters Home Home and Contents Insurance – Keeping safe what matters Welcome to the Home and Contents Insurance Blog from SureInsure an Insurance Brokers in Australia. It is often one of the first types of insurance that someone thinks seriously about. What you choose to put in your home […]